Newsletter

Navigating Canada’s 2024 Capital Gains Tax Changes for Real Estate Owners

With the unveiling of the 2024 federal budget, significant changes are on the horizon, particularly affecting real estate owners. Among these changes, modifications to the capital gains tax structure are pivotal, especially for those holding secondary properties. Understanding these changes is essential for effective financial planning and investment strategy.

Understanding Capital Gains in Real Estate

Capital gains refer to the profit realized when a property is sold for more than its purchase price. For example, if you bought a home for $550,000 and later sold it for $850,000, your capital gain would be $300,000. In real estate, capital gains tax is typically not applied to the sale of a primary residence but does affect secondary properties like cottages, vacation homes, or investment properties.

The New Changes to Capital Gains Tax

Currently, capital gains are taxed at a 50% inclusion rate, meaning only half of your gain ($150,000 of your $300,000 profit) is taxable. The proposed changes in the 2024 budget will increase this rate to two-thirds for gains exceeding $250,000. In the previous example, this means that $200,000 of your $300,000 profit would now be taxable instead of $150,000. This will likely affect many who have real estate investments.

Why the Change?

The government has introduced this change to address income inequality and ensure that those with higher earnings from investments pay a proportionate amount of taxes. This threshold aims to exempt the average Canadian homeowner from increased taxes, targeting instead high-value transactions typically seen in the luxury and investment property markets.

Impact on Real Estate Investors

For those wanting to invest in real estate or purchase a second property for personal use, such as a vacation home, this change means a significant adjustment in calculating potential returns on investments, particularly when selling properties that have appreciated substantially. If you’re contemplating the sale of a secondary property that has seen considerable appreciation, you’ll now face a higher tax bill on the profit exceeding $250,000. It’s crucial for property investors to reevaluate their portfolios and consider timing their sales or exploring other tax strategies.

Strategies for Mitigating Impact

To mitigate the impact of these changes, consider consulting with a real estate lawyer or a tax professional who can provide guidance on planning and possibly restructuring your investments. For example, it might be advantageous to sell certain properties before the tax changes take effect or explore ways to offset losses due to taxation with gains from other investments.

Market Predictions and Economic Impact

Experts predict that these changes might cool down the overheated segments of Canada’s real estate market by discouraging rapid buying and selling of high-value properties. However, the long-term effects on market dynamics and property values remain to be fully seen. Economists expect that the main housing market should remain largely unaffected by these changes.

The 2024 capital gains tax adjustment marks a significant shift for real estate investors in Canada. While it aims to foster fairness in the tax system, it requires careful consideration and planning from those who will be affected. As always, staying informed and seeking professional advice are your best strategies in navigating these changes.

If you own secondary properties or are considering real estate investments, now is the time to talk to your advisor. Understanding these changes and planning accordingly will be key to maintaining the health and profitability of your investments. Have questions or need advice? Feel free to reach out or leave a comment below. Let’s navigate these changes together.

Understanding BC’s New Short-Term Rental Rules: A Guide for Property Owners

The British Columbia Government has introduced the Short-Term Rental Accommodations Act, marking a significant shift in the short-term rental market. Here is a concise overview of how these new rules may impact property owners and prospective buyers in BC. The legislation aims to increase the availability of long-term residential housing by introducing new regulations that property owners should be aware of.

Key Changes Introduced

Starting May 1, 2024, the act brings several important changes:

- Short-term rentals are limited to the host’s principal residence plus one secondary suite or accessory dwelling unit (ADU) in major BC communities.

- Regional districts are empowered to license short-term rentals located outside municipalities.

- Platforms offering short-term rentals must share data to help enforce these rules.

- The concept of grandfathering for existing short-term rentals will be removed.

- A provincial registry for short-term rentals will be created alongside a compliance and enforcement unit.

These regulations apply primarily to residential properties, excluding hotels, motels, and other specific types of accommodations. Additionally, local municipal restrictions may impose stricter rules than those set by the province.

Implications for Property Owners

If you own a property currently used as a short-term rental or are considering entering this market, it’s crucial to understand how these regulations may affect you. The new law requires compliance at both provincial and municipal levels, and ensuring your rental strategy aligns with these rules is key to maintaining a legal and profitable operation.

Guidance for Prospective Buyers

For those looking to purchase property with the intent of short-term rental, the evolving legal framework surrounding housing and rentals in BC means due diligence is more important than ever. The market is responding to a critical housing shortage, and laws are adapting accordingly. Potential buyers should be aware of the current and possible future legal climate surrounding short-term rentals, including the need for legal advice to navigate these waters effectively.

What Does This Mean Moving Forward?

These legislative changes represent a significant shift in how short-term rentals will operate in British Columbia, aiming to address the housing shortage while balancing the interests of homeowners and communities. For property owners and potential buyers, staying informed and consulting with legal experts can provide clarity and direction in this new landscape.

As we navigate these changes, understanding the implications and strategizing accordingly will be crucial for anyone involved in the short-term rental market. Whether you’re an existing property owner or considering a future investment, the evolving regulations underscore the importance of informed decision-making in BC’s dynamic real estate environment.

New Protections for Renters and Landlords in British Columbia

British Columbia is set to introduce significant amendments to the Residential Tenancy Act and Manufactured Home Park Tenancy Act, aiming to create a fairer rental market. These changes are designed to protect both renters and landlords from the pitfalls of the current system, including bad-faith evictions and unreasonable rent hikes, especially when a family grows by adding a child under 19.

Key updates include stricter guidelines to prevent misuse of eviction notices and the implementation of a web portal to standardize eviction processes. This portal will also facilitate post-eviction audits to ensure compliance. The amendments also offer increased protection against rent increases, mandating that no rent hikes above the annual allowable increase can occur due to the addition of new occupants.

Additionally, the government is improving the efficiency of resolving rental disputes. By enhancing the Residential Tenancy Branch’s capabilities, the wait times for dispute resolution have significantly decreased, ensuring quicker resolutions for both unpaid rents and utility disputes.

These legislative changes are part of the government’s broader initiative, the Homes for People Action Plan, aimed at tackling the housing crisis and making residential tenancies more secure and fair for everyone involved.

For renters and landlords in British Columbia, these updates mean a more stable, predictable, and fair renting environment, contributing positively to the province’s overall housing health.

British Columbia Housing Market Update: March 2024

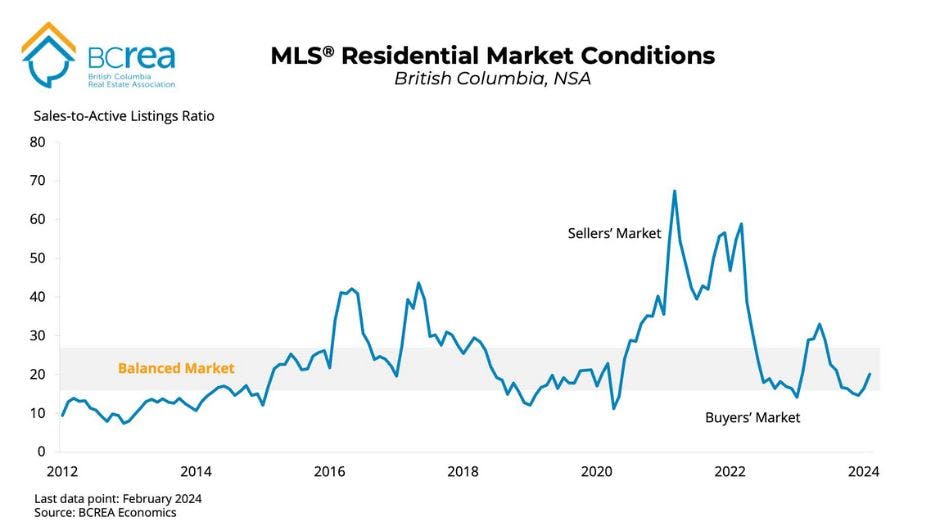

The latest data from the British Columbia Real Estate Association provides a comprehensive look at the housing market as of February 2024. Here’s what you need to know about the current trends in residential sales, listings, and prices across the region.

Sales and Price Trends

Residential sales in British Columbia saw a diverse pattern across various regions in February. Notably:

– Greater Vancouver experienced a significant increase in unit sales, up 14.1% year-over-year, with an average price growth of 4.4%.

– Fraser Valley also saw a sharp rise in sales, up 37.8%, and an impressive 8.3% increase in average prices.

– Conversely, the Okanagan witnessed a decline in sales by 3.4% with a notable 7.1% drop in average prices, reflecting a cooling market in this area.

These fluctuations indicate a mixed response to market conditions, influenced by factors such as local economic dynamics and housing supply.

Active Listings and Market Supply

February 2024 also highlighted changes in the supply side of the market:

– Greater Vancouver’s active listings increased by 16.3% compared to last year, with a 4.7 months supply indicating a more balanced market.

– Fraser Valley saw a significant 37.9% increase in active listings, with months of supply at 3.8, suggesting a shift towards a seller’s market.

– Victoria and Vancouver Island also reported increases in active listings and modest changes in months of supply, pointing towards growing inventory levels.

Long-Term Price Trends

The Average MLS® Residential Price in British Columbia has shown a steady climb over the years, reaching new heights in 2024. The trend line suggests a continuing upward trajectory in property values, driven by sustained demand and limited housing supply in key areas.

Conclusion

The British Columbia housing market continues to exhibit a complex landscape with regional variances in sales, prices, and inventory levels. Potential homebuyers and sellers should consider these trends carefully and stay informed about local market conditions to make well-informed decisions. For those considering entering the market, these insights are invaluable for navigating the current real estate environment.

If you have any questions about your local real estate market, get in touch! We’d love to help you out!

New Tax Exemptions in B.C.: A Game Changer for Buyers and Sellers

The British Columbia government recently rolled out significant changes to the Property Transfer Tax (PTT), marking a pivotal shift in the real estate landscape. For buyers, especially first-time buyers and those eyeing new constructions, the road to homeownership just got a bit smoother. The exemption threshold has been lifted to from $750K to $1.1 million for new construction homes and increased from $500K to $836K for first-time buyers, introducing a wave of opportunities and savings.

For sellers, this adjustment may stimulate market activity, inviting more buyers to the table. Properties that align with the new exemption criteria could see increased interest, potentially speeding up sales and even boosting property values in certain segments.

What does this mean for you? Buyers can now stretch their budgets further, possibly affording homes that were just out of reach before. Sellers, on the other hand, might find a more vibrant market eager for properties that meet the exemption criteria.

Whether you’re looking to buy a home or considering selling, these updates could impact your decision-making process. For a more thorough look at these changes visit our blog at Property Transfer Tax Updates. If you have any questions about how these changes may impact you and your plans, feel free to reach out. We’d love to chat!

BC’s Proposed Home Flipping Tax Explained

The BC government recently proposed a home flipping tax, set to roll out on January 1, 2025. This move aims to anchor the real estate market towards long-term investment rather than quick speculative gains. Let’s dive into what this means for you.

The Heart of the Matter

In essence, this tax is designed to deter rapid buying and selling of properties for profit, with a sliding tax scale hitting hardest for sales within the first year decreasing to zero after two years.

Our Perspective

In our neck of the woods, flipping houses isn’t a big business so we don’t anticipate it having a a big effect on our local real estate market. If anything, it might weed out the few looking for a quick flip, particularly in pre-sales, ensuring those homes go to those wanting to put down roots rather than speculators hoping to cash in.

Keep an eye out on our blog at kylerealestate.ca for more updates and insights as they’re announced.